While Oculus doesn’t offer much publicly in the way of understanding how well individual apps are performing across its VR storefronts, it’s possible to glean some insight by looking at apps relative to each other. Here’s a snapshot of the top 20 Oculus Quest games and apps as of August 2021.

ℹ️ Why We Publish This Data

While the SteamVR library already has a comprehensive tracking database thanks to SteamDB, Steam 250, and more, no similar database exists to track applications on Oculus storefronts. We publish this data to give users, developers, and analysts insight into the Oculus app landscape.

Some quick qualifications before we get to the data:

- Paid and free apps are separated

- Only apps with more than 100 reviews are represented

- App Lab apps are not represented

- Rounded ratings may appear to show ‘ties’ in ratings for some applications, but the ranked order remains correct

Best Rated Paid Oculus Quest Apps

The rating of each application is an aggregate of user reviews and a useful way to understand the general reception of each title by customers.

| Rank | Name | Rating (# of ratings) | Rank Change | Price |

| #1 | The Room VR: A Dark Matter | 4.89 (7,612) | ≡ | $30 |

| #2 | Cubism | 4.85 (433) | ≡ | $10 |

| #3 | Walkabout Mini Golf | 4.85 (3,334) | ≡ | $15 |

| #4 | Swarm | 4.83 (999) | ↑ 1 | $25 |

| #5 | Moss | 4.82 (4,870) | ↓ 1 | $30 |

| #6 | I Expect You To Die | 4.81 (3,645) | ≡ | $25 |

| #7 | Warplanes: WW1 Fighters | 4.8 (980) | New | $20 |

| #8 | The Thrill of the Fight | 4.8 (5,920) | ↓ 1 | $10 |

| #9 | YUKI | 4.79 (110) | New | $20 |

| #10 | GORN | 4.78 (4,676) | ↓ 2 | $20 |

| #11 | Five Nights at Freddy’s: Help Wanted | 4.77 (6,004) | ↓ 1 | $30 |

| #12 | Pistol Whip | 4.77 (7,059) | ↓ 1 | $30 |

| #13 | ALTDEUS: Beyond Chronos | 4.77 (886) | ↓ 4 | $40 |

| #14 | In Death: Unchained | 4.75 (2,891) | ≡ | $30 |

| #15 | Yupitergrad | 4.74 (370) | ↓ 2 | $15 |

| #16 | Trover Saves the Universe | 4.74 (1,661) | ↓ 1 | $30 |

| #17 | Racket: Nx | 4.73 (1,506) | ↓ 1 | $20 |

| #18 | SUPERHOT VR | 4.72 (13,299) | ↓ 6 | $25 |

| #19 | Down the Rabbit Hole | 4.72 (1,105) | ↓ 1 | $20 |

| #20 | Job Simulator | 4.72 (7,742) | ↓ 3 | $20 |

Rank change & stats compared to July 2021

Dropouts:

Vacation Simulator, Until You Fall

- Among the 20 best rated Quest apps

- Average rating (mean): 4.8 out of 5 (±0)

- Average price (mean): $23 (–$1)

- Most common price (mode): $30 (±$0)

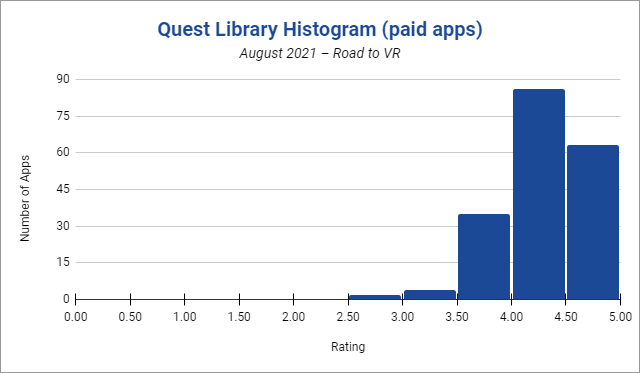

- Among all paid Quest apps

- Average rating (mean): 4.3 out of 5 (±0)

- Average price (mean): $19 (±0)

- Most common price (mode): $20 (±$0)