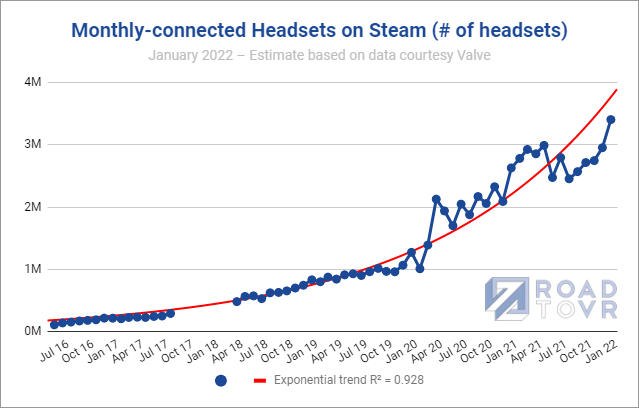

The holiday period has consistently been a significant time of growth for VR and holiday 2021 was no different. Largely driven by an influx of new Quest 2 users, VR headsets on Steam handily reached a new record high with an estimated 3.4 million monthly-connected headsets.

Monthly-connected VR Headsets on Steam

Each month Valve collects info from Steam users to determine some baseline statistics about what kind of hardware and software is used by the platform’s population, and to see how things are changing over time, including the use of VR headsets.

The data shared in the survey represents the number of headsets connected to Steam over a given month, so we call the resulting figure ‘monthly-connected headsets’ for clarity; it’s the closest official figure there is to ‘monthly active VR users’ on Steam, with the caveat that it only tells us how many VR headsets were connected, not how many were actually used.

While Valve’s data is a useful way see which headsets are most popular on Steam, the trend of monthly-connected headsets is obfuscated because the data is given exclusively as percentages relative to Steam’s population—which itself is an unstated and constantly fluctuating figure.

To demystify the data Road to VR maintains a model, based on the historical survey data along with official data points directly from Valve and Steam, which aims to correct for Steam’s changing population and estimate the actual count—not the percent—of headsets being used on Steam.

According to the latest data from Valve, VR headsets on Steam reached 2.14% of the Steam audience in January 2022. While this proportion falls short of the 2.31% record reached in May 2021, the estimated count of actual VR headsets has reached a significant new milestone of 3.4 million in January 2022 (compared to 2.98 million in May 2021).

The count of VR headsets on Steam had flirted with the 3 million milestone on several occasions but hadn’t quite surpassed it last month when it saw a significant jump from 1.93% (2.95 million) in December 2021 to 2.14% (3.4 million) in January 2022.

Year-over-year, the count of monthly-connected VR headsets on Steam is up 29.46%.

It’s impressive to see the number of VR headsets on Steam reaching this new milestone, though perhaps even more interesting will be to watch and see how many players stick around for the long haul. Will this be a temporary spike or a lasting impact?

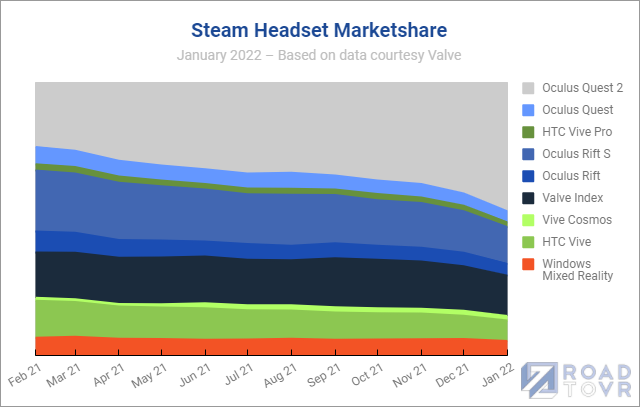

Share of VR Headsets on Steam

Quest 2 was far and away the most significant driver in the growth of monthly-connected VR headsets on Steam in January. Clearly spurred by the 2021 holiday season, Quest 2 reached a record high of 46.02% (+6.40%), its largest single month of growth ever.

Given Quest 2’s significant growth, most other headsets gave up some share of the pie. The Oculus Rift S and Valve’s Index headset saw the most significant losses in share, with falling to 13.10% (−1.67%) and 14.36% (−1.43%), respectively.

Less popular headsets like the original HTC Vive at 7.31% (−0.95%) and Windows VR headsets at 4.99% (−0.70%) lost less share. This suggests that the 2021 holiday season saw many Rift S and Valve Index owners trading up to a Quest 2 while other headsets were less likely to jump on board with the newer headset.

However, despite Rift S, Index, HTC Vive, and Windows VR losing share, all of these headsets actually gained in count. That’s because the size of the pie itself grew enough to more than cover the losses in share.

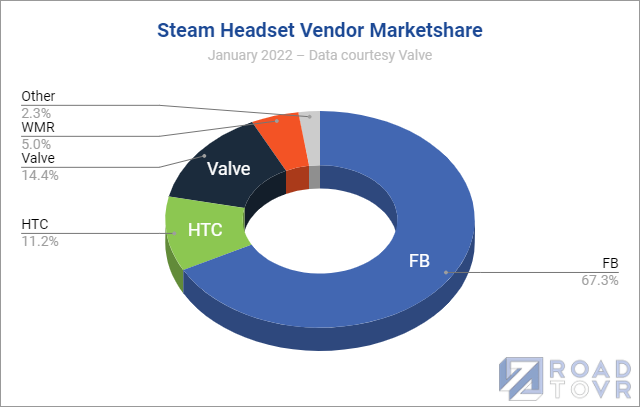

From a vendor standpoint, Meta’s steady gains accelerated in January thanks to Quest 2 (and despite losses in share from Quest 1 and Rift S), with the company’s headsets now making up 67.25% (+3.67%) of monthly-connected VR headsets on Steam.