Mojo Vision announced it’s secured a $75 million Series B Prime investment round, which the company says will support the commercialization of its powerful and flexible micro-LED platform for XR glasses.

The round was led by Vanedge Capital, and included investments from current shareholders Edge Venture Capital, New Enterprise Associates (NEA), Fusion Fund, Knollwood Capital, Dolby Family Ventures, and Khosla Ventures, and new shareholders, including imec.xpand, Keymaker, Ohio Innovation Fund, and Hyperlink Ventures.

This brings the company’s overall funding to $345 million, according to Crunch Base data; Mojo Vision’s penultimate round came in late 2023, amounting to $43.5 million.

While previously geared towards producing smart contact lenses, Mojo Vision is now all about the underlying micro-LED technology that initially generated headlines back in 2022.

At the time, it was expected Mojo Vision would commercialize a contact lens with embedded micro-LED display, however in April 2023 the company announced it was pivoting.

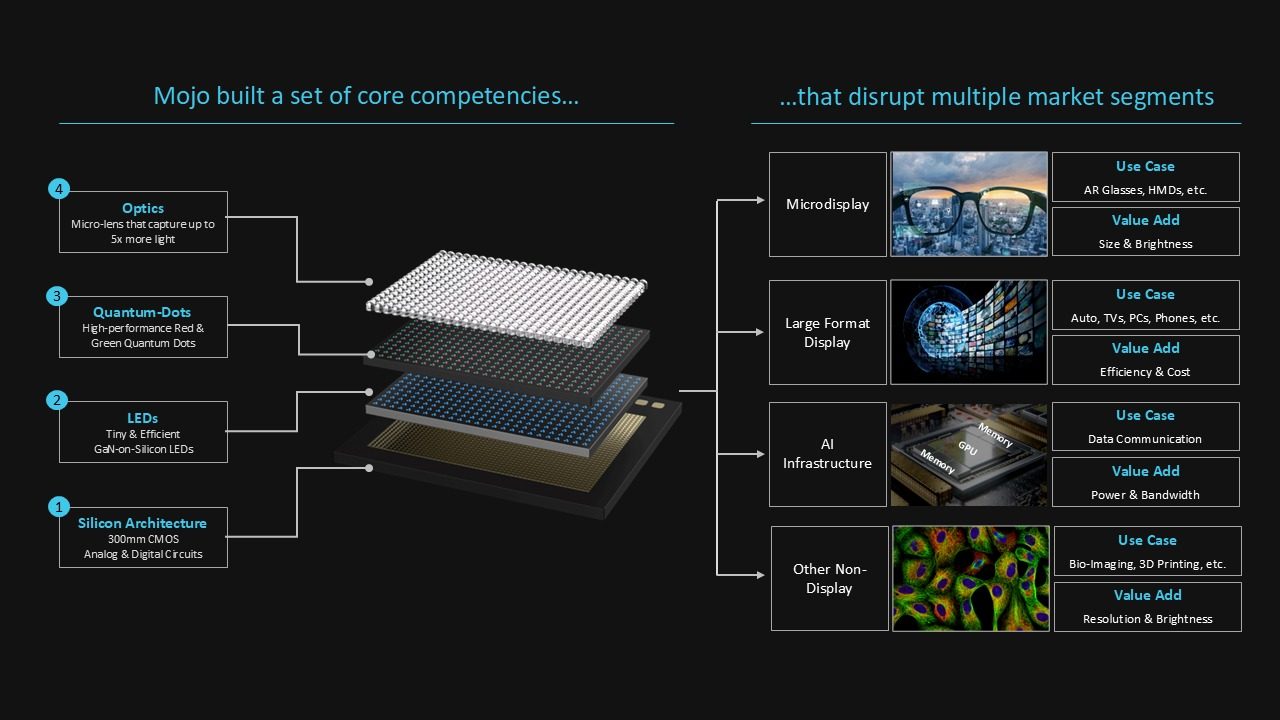

Founded in 2015, Mojo Vision is now building a type of micro-LED technology that allows the mass-production of them onto silicon chips, combining advanced components like gallium nitride (GaN) on silicon emitters, quantum dots, and micro-lens arrays. According to Mojo Vision, this makes the displays very bright, very small, and energy-efficient.

“Through our micro-LED technology development, Mojo has made significant advancements in establishing breakthrough performance standards while laying the foundation for micro-LEDs as a platform for AI innovation in large market segments,” said Nikhil Balram, CEO of Mojo Vision. “This oversubscribed funding round and strong industry support mark a new phase in the design and production of our next-generation micro-LED platform. The company is on an accelerated path to commercialize micro-LED applications that can power AI.”

The company says it’s targeting the micro-LED platform to build displays for XR glasses, but also large format displays and optical interconnects for AI infrastructure.