The launch of Android XR, a newly announced headset from Valve, and major strategic shifts at Meta are just the start of what made 2025 a significant year for the XR industry at large. 2026 will mark the 15th year that we’ve been following this XR journey here at Road to VR. With the context that comes with that long-term perspective, it’s once again time to reflect on the biggest stories of the last year and to talk about what’s on the horizon.

Meta Makes Aggressive Cuts as It Shifts XR Strategy

In early 2025, Meta CTO Andrew Bosworth issued a memo calling it a ‘make or break’ year for the company’s XR ambitions.

“This year likely determines whether this entire [XR] effort will go down as the work of visionaries or a legendary misadventure,” Bosworth wrote.

Well, by early 2026 it’s looking like “legendary misadventure” takes the cake.

Apparently not seeing the growth and traction it wanted, Meta is making an aggressive shift in its XR strategy. The last few days have seen reports of multiple first-party VR studios being cut down to size or outright shuttered. The company’s business-focused virtual collaboration space, Horizon Workrooms, is being shut down, and more. In total, the company is said to be cutting roughly 10% of its entire Reality Labs division as it shifts focus away from VR and “metaverse” efforts.

What it Means for 2026

It’s going to take a while for the dust to settle on this, and it probably won’t be until Q2 that the company shares a clear vision for what it hopes to accomplish with the cuts and new direction.

From what I’m seeing and hearing, it sounds like Meta isn’t exiting the XR space, but it’s shifting focus more strongly toward the glasses end of the spectrum, while doing away with the notion that building a “metaverse” (a digital space where people would gather, play, and work) is a strategic imperative.

Rather, it looks like Meta will continue to run its XR headset platform and let it evolve naturally rather than trying to place big content bets or force the metaverse into existence. Meanwhile, the company is said to be focused on boosting production of its smart glasses to serve growing demand.

Although that likely means a greater focus on smart glasses and AI assistants for the time being, it’s clear that the company’s end-goal is (and has been) to evolve its smart glasses into full-blown augmented reality glasses over time. In fact, Meta showed an early vision of this end goal back in 2024 with the Orion prototype. The 2025 release of the Ray-Ban Display glasses, and the ‘neural band’, was a clear step toward that goal.

Ray-Ban Display is still just a pair of smart glasses (i.e.: a small field-of-view and a static display with no tracking). But already the company that makes the waveguide in Meta’s glasses says it has a much larger 70° field-of-view waveguide that’s ready for production.

For many years I’ve explained that the industry has been working on the challenge of compact and affordable XR devices from two sides. On one hand, the industry has started by packing a wishlist of features into a bulky headset, and then trying to make it smaller. On the other hand, the industry is starting from a tiny glasses-like package, and then trying to add back all the features enjoyed by the bulkier headsets.

Meta has mostly focused on the former (headsets), but it’s now shifting focus to the latter (glasses). The end goal, however, remains the same: an affordable and comfortable device that can digitally alter the world around you.

This shift isn’t just a big deal for Meta, it’s a big deal for the whole industry. Meta has been dominant in the space for years, thanks in large part to being able to out-price the competition and attract developers, thus building the leading standalone headset platform. With its standing in the industry, Meta has been able to direct much of what has happened within the industry, either explicitly or implicitly.

If Meta is pulling back on its VR and metaverse initiatives, the door may open for another company to take over its influential role. Or, the space might settle into a new equilibrium with a renewed competitive landscape, which has long been suffocated by Meta.

All we can say for certain is that 2026 will be a year of major realignment as the industry figures out how hands-on Meta plans to be with its VR platform going forward.

The Biggest Year in Recent History for XR Hardware

2025 turned out to be a huge year for XR hardware launches and announcements.

Google finally revealed and launched Android XR, a direct competitor to Apple’s VisionOS. Samsung launched the first Android XR headset, Galaxy XR, a direct competitor to Apple’s Vision Pro.

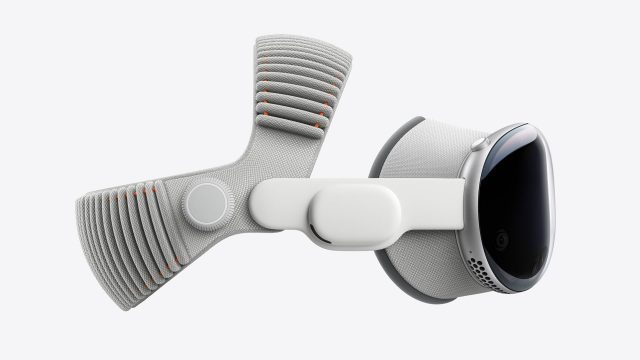

Apple also launched a new version of Vision Pro with an upgraded processor and (finally) an improved headstrap. And after years of rumors and speculation, Valve announced Steam Frame, its second-ever VR headset.

In parallel, we’re also seeing the rapid heating up of the smart glasses and AR glasses space.

Meta launched updated versions of its smart glasses, including Ray-Ban Display, its first smart glasses with a display. XREAL previewed Aura, which is set to launch in 2026 as the first AR headset running Android XR. The company subsequently raised $100 million in new funding as it announced an extended partnership with Google. VITURE, a company with similar approach to smart glasses and AR glasses, also raised $100 million in 2025.

What it Means for 2026

Although they happened in the same year, all of these announcements represent the culmination of investments and development that happened over the last several years. With three major tech titans making XR plays (Meta, Apple, and Google), 2026 is shaping up to see a level of competition that truly hasn’t been seen yet since I started reporting on the industry back in 2011.

Meanwhile, Valve is taking a whole new approach to its VR architecture. Frame is a fully standalone headset—a first for Valve—and the company has designed it to be a better companion to people’s existing Steam library, by allowing it to play pretty much any Steam game (VR or otherwise) either locally or streamed from a nearby PC.

While Valve is giving PC VR some much needed love, I’m still not convinced that Frame is going to revolutionize the space. Although it has some neat extras (like improved wireless game streaming thanks to eye-tracked optimizations), it doesn’t really do that much more than a Quest 3 or Quest 3S, which will inevitably be the cheaper options. As with its prior headset, Frame will probably remain limited to an enthusiastic niche of hardcore PC VR players. But ultimately, Frame shows that Valve never stopped caring about VR and that the company is still focused on making Steam an open VR platform on PC that will be maintained for years to come.

Meta has been hard at work prototyping full-blown AR glasses, but it hasn’t actually launched such a product yet. Meanwhile, Xreal and Viture have been rapidly evolving their smart glasses with growing AR capabilities, seemingly catching companies like Meta by surprise. The pair of $100 million investments into Xreal and Viture (and especially Xreal’s close partnership with Google) will put pressure on Meta to release its AR glasses sooner rather than later.

Valve Reveals a New Headset, But Confirms No New First-party VR Game to Go With it

Given that Valve launched Half-Life: Alyx back in 2020 to show what was possible with its first VR headset, there was widespread speculation that the company would similarly announce a new VR game to launch alongside Steam Frame. But as the company told me directly, there is no new first-party VR game in development.

What it Means for 2026

The lack of a flagship launch title to go out the door with Steam Frame has left many scratching their heads. New headsets are exciting, but given the dearth of exciting PC VR content in the last few years, what are people actually going to play… more Beat Saber?

I’m glad Valve is still in on VR, but I’m not exactly bullish on Frame. Luckily the PC VR landscape has never had more options to serve various hardcore PC VR niches, thanks to companies like Pimax, Bigscreen, and Shiftall—and hey, even Sony technically makes a PC VR headset!

A Shifting VR Player Demographic Comes to a Head as Veteran VR Studios Struggle to Stay Afloat

2025 was a brutal year for established VR studios. Highly immersive single-player apps were once the bread and butter of VR gaming. But VR was not insulated from the broader gaming industry shift toward free-to-play multiplayer games.

That shift seems to have reached a peak just as a wave of prior long-term bets on single-player VR content was coming to fruition in 2025. The result has been report after report of established VR studios struggling to stay afloat.

Among studios seeing underwhelming revenue, staff cuts, or outright closures this year was Cloudhead Games, Fast Travels Games, Soul Assembly, Vertigo Games, Toast Interactive, nDreams, and Phaser Lock. Not to mention Meta shuttering several of its first-party VR game studios that were focused on single-player content.

On the other hand, new studios focused on free-to-play multiplayer content have seen rapid growth and seemingly reached unprecedented new peaks of player counts and retention. Games like Gorilla Tag, Animal Company, Yeeps, and UG are dominating Quest’s Top Selling Charts by serving a younger demographic of players looking for free-to-play multiplayer experiences. Interestingly, all four of these newer top-earning titles are also built around arm-based locomotion.

What it Means for 2026

Whether we like it or not, free-to-play multiplayer is here to stay. Many of the most popular non-VR games are free-to-play multiplayer games, so it should be no surprise that the same formula would take over VR as well. The unfortunate part is that the transition happened so fast that by the time the latest wave of big budget single-player VR games landed, they were launched into a void of demand. With production times of some bigger VR games spanning 1-3 years, it’s difficult to course-correct.

Especially with Meta’s latest cluster of studio closures, the message is now unambiguous: premium single-player VR games are no longer what the bulk of active VR users are looking for. That’s not to say there’s no room for great single-player experiences in VR, but the demand for them isn’t what it used to be.

Of the veteran VR studios that have managed to weather the storm, I expect to see many of them take their first stab at free-to-play multiplayer VR games, or focus on ‘VR optional’ titles, or even leave VR for the time being while they seek greater stability in the larger gaming market.

Frankly, I think this situation has a bit less to do with the ‘free-to-play’ part, and more to do with the ‘multiplayer’ part. As with almost every entertainment activity in existence, most people like to play games with their friends. The rise of massively successful paid multiplayer games with structures that are reminiscent of traditional single-player games (ie: Destiny, Valheim, Helldivers, Arc Raiders) tells me that pure single-player games as a whole will one day become a thing of the past.

That’s not to say that we won’t see great, ‘single-player style’ games still made (like, say, Red Dead Redemption 3) but I bet you’ll at least have the option to play them with a friend or two.

Vision Pro First Generation Pathfinding

2025 was the year that we saw Apple working to fix first-generation product issues with Vision Pro. That included adding official support for PSVR 2 Motion Controllers and a Logitech stylus, several major new features included in the launch of VisionOS 26, and a refresh of the headset with a more powerful M5 processor and a better headstrap.

What it Means for 2026

These changes were all clearly meant to address first-generation pain points. Specifically, the improved headstrap was a major admission that the headset was too heavy and bulky. Unfortunately a better head strap can only do so much.

I don’t expect we’ll see any new XR hardware from Apple in 2026. But I do expect to see the company continue to make more of these first-generation fixes and to further improve the headset’s most promising use-cases on the software side. I’m still personally hoping for better window management.

While there’s been much reporting about Vision Pro as a ‘failed’ product, those that are actually connected to the XR industry understand that Vision Pro is a significant contribution to the state-of-the-art that’s really only held back by its current size and weight. I’m certain Apple knows this too.

My bet is that Apple is far from done with Vision Pro and VisionOS. It’s rare for the company to make a product play only to cancel it after one generation. More likely, I’m willing to bet that Apple has set new and specific goals for the size and weight of its next Vision headset, and will happily wait for years until it can actually meet those goals. In the meantime, it will continue to invest in VisionOS, which I’ve long said is a more important contribution to the industry than the headset hardware itself.

2025’s “WTF” Moment

What seemed on its face like an April Fool’s joke, was anything but. In 2025 Nintendo announced it is revitalizing its Virtual Boy console.

First released in 1995, the Virtual Boy was portrayed as a type of “virtual reality” experience, but considering its small field-of-view, lack of motion tracking, and single-color (red) display, it was functionally just a 3D display on a stand. Still, the console has been culturally associated with “virtual reality” ever since—and it’s not exactly a positive association.

Ambitious as it was, Virtual Boy was an infamous failure of a game console, owed largely to its minimal game catalog, single-color display, and reports of motion sickness while playing. It was discontinued less than a year after launch.

The upcoming $100 accessory will use Switch or Switch 2 as the brains (and display) of the device, and it will play original Virtual Boy games like Mario’s Tennis, Teleroboxer, and Galactic Pinball, with a planned total of 14 titles to be launched in time (that may not sound like many, but it’s more than 50% of the entire Virtual Boy game catalog).

Nintendo will also sell a $25 ‘cardboard’ version of the Virtual Boy accessory which will allow Switch to play the same games but without the stand and plastic facade to hold the console.

We still don’t know if the games are simply being emulated or if they have been retouched or remastered. I hope they’ll be at least updated to render at the native Switch or Switch 2 resolutions, rather than the tiny 0.086MP (384 × 224) per-eye resolution of the original Virtual Boy.

What it Means for 2026

Nintendo continues its long history of weird decisions, and I’m here for it.

2026 Wildcards: Snap & HTC

In my book, the biggest wild cards for 2026 are Snap and HTC.

HTC was once a prominent player in the VR space, having built a long line of PC VR headsets that rivaled Meta’s Rift. But once Meta shifted focus to standalone, HTC wasn’t able to keep up. Sure, HTC released several standalone headsets, but none have come close to the consumer and developer traction of Meta’s Horizon.

That’s left HTC meandering over the last several years, culminating last year in the unexpected sell-off of much of its XR engineering talent to Google for $250 million. Since then, HTC has followed Meta into the smart glasses space with VIVE Eagle. But, so far, the glasses have only launched in Taiwan.

Exactly where HTC heads next is unclear. Will it follow Meta’s lead again and shift its primary focus to smart glasses? Or could it swoop in and try to fill the vacuum left by Meta’s pullback from the VR and metaverse space?

The latter could be a significant opportunity for the company which, at very least, has the same core pieces already in place (standalone VR headsets, an app store, and a ‘metaverse’ platform). Not to mention strong traction in the B2B and LBE spaces, which Meta never quite got a handle on.

As for Snap, the company has been planning its entry into the consumer AR space for years at this point. Last year the company’s CEO effectively said that its bet on the AR space is fundamental to the company’s continued existence.

The company has launched two generations of its ‘Spectacles’ AR glasses, and the company has spent time focusing on developers and building out tooling based on feedback.

Snap plans to launch its first pair of consumer AR glasses this year, but it remains to be seen if it has any unique technological advantages compared to what’s already out there. Even if not, it’s possible that Snap’s social and fun-focused approach to AR glasses could be a winning play, especially if it can successfully draw its fleet of Snapchat AR developers over to its glasses. The company says that’s the plan, anyway, as it has been building tools that make it easier for developers to build Lenses that span both hand-held and head-worn AR.

– – — – –

As someone who has been reporting on this industry for nearly 15 years now, I truly mean it when I say I believe 2025 will be looked back upon as one of the most significant moments for the XR industry overall. The next five years are certain to see more change, competition, and innovation than the last five years.

What were your biggest XR stories of 2025 and what do you think is coming in 2026? Drop a line in the comments to let us know!